What Is Real Estate Tokenization?

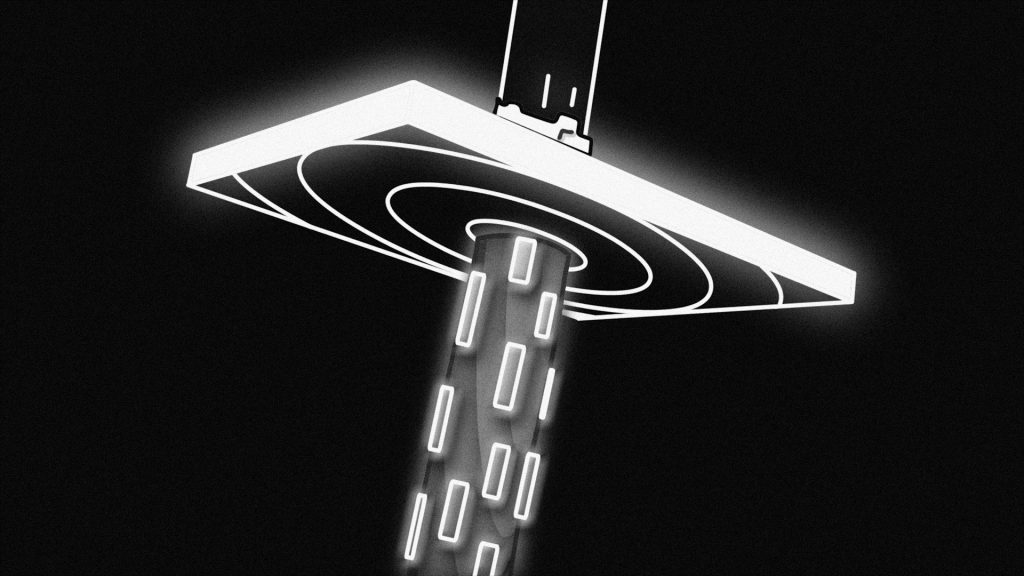

Real estate investment has traditionally required substantial capital and involved complex, time-consuming transactions. These barriers have kept many investors from accessing more profitable property markets, especially high-value commercial or luxury assets. Tokenization changes this by breaking ownership into digital shares, allowing investors to buy and sell fractions of properties with ease.

This shift leverages blockchain technology to create secure, transparent records of ownership and transactions. By converting real estate assets into digital tokens, investors gain unprecedented flexibility and access to a global marketplace. This post explores how real estate tokenization works, its advantages, and the risks to consider before diving in.

Key Takeaways

- Real estate tokenization converts property ownership into digital tokens on a blockchain, enabling fractional investing and easier trading.

- Tokenization increases liquidity, lowers entry barriers, and reduces transaction costs compared to traditional real estate investing.

- Regulatory uncertainty and market development challenges remain key risks investors should evaluate before participating.

What Is Real Estate Tokenization?

Real estate tokenization involves converting the value of a real estate asset into digital tokens on a blockchain. This process enables you to own and trade these tokens, representing fractional ownership of the property, rather than buying the entire asset yourself.

Tokenization makes real estate investment more accessible and flexible, allowing you to diversify your portfolio with ease:

- Blockchain: This is the underlying technology that ensures security and transparency in transactions. It acts as a decentralized ledger, recording all token exchanges and property transactions without the need for intermediaries.

- Tokens: These are digital representations of ownership in a real estate asset and are frequently touted as the future of property investment. Each token signifies a share in the property, allowing you to invest in a portion rather than the whole asset, which can greatly enhance liquidity and investment opportunities.

- Digital Ownership: Through tokenization, you gain a form of digital ownership that simplifies the process of buying, selling, and managing real estate assets. Digital ownership streamlines transactions and reduces costs, making it easier for you to engage in the real estate market.

How the Tokenization Process for Real Estate Works

Identifying the Asset

The first step in the tokenization process involves identifying the real estate asset you wish to tokenize. You’ll need to determine the property’s current value and assess its potential for fractional ownership. By conducting a thorough appraisal and considering market trends, you gain a deeper understanding of the asset’s worth and the potential demand for its tokens. This groundwork ensures that the tokenization process begins with a clear and accurate valuation.

Once the asset is identified, you proceed by gathering necessary documentation and ensuring it meets all legal and regulatory requirements. This might involve consulting with legal experts to verify ownership and compliance, setting the stage for a smooth transition into the digital world. By laying down these foundations, you prepare the asset for its journey into tokenization, ensuring it is both legally sound and attractive to potential investors.

Structuring the Token Offering

After identifying the asset, the next step is structuring the token offering. Here, you decide the number of tokens to be issued, their value, and the rights associated with each token. This stage is crucial as it shapes the investment proposition for potential buyers. You’ll need to work closely with financial advisors to design a token structure that aligns with your investment goals while appealing to a broad audience.

The token offering is then formalized through a whitepaper, which outlines all the essential details of the investment opportunity. This document serves as the cornerstone for attracting investors, providing transparency about the asset, the technology behind the tokens, and the expected returns. By clearly defining the token offering, you set the terms for how investors will engage with your real estate asset.

Creating and Issuing Tokens

With the structure in place, you move on to creating and issuing the tokens. This involves using blockchain technology to generate digital tokens that represent shares in the real estate asset. The blockchain’s decentralized nature ensures that each token is secure and traceable, providing a reliable record of ownership. By leveraging blockchain, you enhance the transparency and security of the investment process, building trust with potential investors.

Once created, the tokens are distributed to investors through a secure digital platform. This platform manages the buying, selling, and trading of tokens, making it easy for you to interact with your investment. By facilitating seamless transactions, you provide investors with a straightforward and efficient way to engage with the real estate market, encouraging broader participation.

Managing Ownership and Distribution

Finally, managing ownership and distribution is key once the tokens are in circulation. This step involves continuously monitoring the blockchain for transactions and updates, ensuring that ownership records remain accurate and up-to-date. A robust management system helps you track who owns what percentage of the asset, streamlining the process of distributing any returns or dividends to token holders.

Additionally, you must stay compliant with any ongoing regulatory requirements that may affect token holders. This might involve regular audits or updates to the token structure based on market conditions or changes in legislation. By maintaining an efficient management and distribution system, you ensure that both you and your investors reap the benefits of tokenized real estate with confidence and security.

Benefits of Tokenizing Real Estate for Investors

- Increased Liquidity: Tokenization transforms real estate into a more liquid asset. By allowing fractional ownership, you can easily buy or sell your share, making real estate investments as fluid as trading stocks.

- Global Market Access and Diversification: With tokenized assets, you’re not limited by geography. You can access and invest in properties worldwide, diversifying your portfolio beyond local markets and mitigating regional risks.

- Reduced Transaction Costs: Traditional real estate transactions can be costly due to fees and intermediaries. Tokenization streamlines this process, minimizing costs and maximizing your investment returns.

- Streamlined Processes: Blockchain technology simplifies the management of real estate investments. You enjoy faster transactions, transparent records, and reduced paperwork, making the investment process more efficient.

- Greater Accessibility: Tokenization lowers the barrier to entry for real estate investment. You can participate with smaller amounts of capital, making it possible to invest in high-value properties previously out of reach.

Potential Risks and Considerations

- Regulatory Uncertainty: The legal landscape for tokenized real estate is still evolving. You need to stay informed about regulations in different jurisdictions, as changes can impact your investment’s legality and profitability.

- Market Volatility: Like any investment, tokenized real estate can be subject to market fluctuations. It’s essential to be prepared for potential changes in property value and token prices that may affect your portfolio.

- Technological Challenges: Relying on blockchain technology means you must consider potential technical issues or disruptions. Staying updated on technological advancements and safeguards is crucial to protecting your investment.

- Security Concerns: Digital investments come with cybersecurity risks. You should ensure robust security measures are in place to protect your tokens from hacking or fraud, maintaining the integrity of your assets.

- Liquidity Issues: While tokenization aims to increase liquidity, the market for tokenized real estate is still developing. You might face challenges in finding buyers or sellers, which could impact your ability to quickly liquidate assets.

Frequently Asked Questions

What is real estate tokenization?

Real estate tokenization is the process of converting ownership rights in a property into digital tokens on a blockchain. Each token represents a fractional share, allowing investors to buy, sell, or trade portions of the asset.

How does blockchain technology support tokenization?

Blockchain acts as a decentralized ledger that records all token transactions securely and transparently without intermediaries. This ensures accurate ownership tracking and reduces fraud risks.

What are the benefits of fractional ownership through tokenization?

Fractional ownership lowers the capital required to invest, enabling broader participation and portfolio diversification. It also allows investors to liquidate shares more easily compared to traditional whole-property sales.

What legal and regulatory challenges affect tokenized real estate?

Regulations vary by jurisdiction and are still evolving, impacting how tokens are issued, traded, and taxed. Investors must stay informed and work with legal experts to ensure compliance.

Are there risks associated with real estate tokenization?

Yes, risks include market volatility, limited liquidity in emerging token markets, cybersecurity threats, and potential regulatory changes. Proper due diligence and robust security measures are essential to mitigate these risks.

Are you looking to connect with property owners, landlords, and real estate investors?

Ready to grow your business by connecting with property professionals?

Master the art of real estate investing with The Real Estate Property Management Guide: Premium Edition – your comprehensive roadmap to successful property management.

Whether you’re a novice investor or seasoned professional, this guide covers everything from selecting the right investment properties to tenant management and property marketing.

The author, Jeff Rohde writing as Jeffrey Roark, is a professional with over 25 years of real estate experience. This Premium Edition includes the valuable bonus book Investment Real Estate Analysis: A Case Study to help you identify hidden opportunities and evaluate properties like a professional.

Learn practical, actionable strategies for both residential and commercial properties, from single-family homes to office buildings and shopping centers.

Don’t just buy property – learn how to manage it successfully and maximize your investment potential.