Posts Tagged ‘ROI’

How to Use Market Rent in Real Estate Investing

Market rent is the typical rental rate a property could command in the current market based on location, size, condition, and amenities, serving as a critical benchmark for determining rental property profitability. Getting this number wrong costs you money either through extended vacancies from overpricing or lost income from underpricing. Understanding the market rent potential…

Read MoreHow To Check Out a Real Estate Developer

When you invest in a new property, your decision isn’t just about the building—you’re also placing trust in the real estate developer behind it. Thoroughly checking out a real estate developer is one of the most important steps before making any investment commitment. A few smart moves up front can save you from costly regrets.…

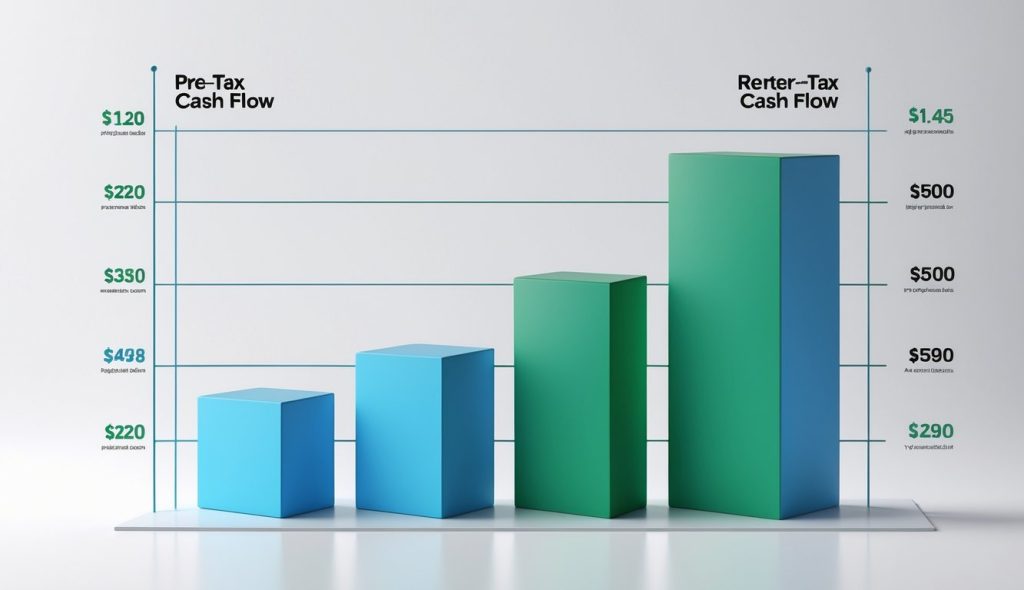

Read MoreHow to Maximize Pre-Tax Cash Flow in Real Estate Investing

Understanding your property’s pre-tax cash flow can make the difference between a profitable investment and a financial pitfall. Pre-tax cash flow is the amount of money your investment generates after accounting for operating expenses and debt service, but before any taxes are paid. Knowing how to calculate and analyze this metric gives you a more…

Read MoreThe Truth About Cash on Cash Return in Today’s Market

Understanding which numbers really matter is crucial when investing in real estate. Cash on cash return is a simple yet powerful way to measure the actual cash income you earn compared to the cash you invest in a property. Knowing how to use this metric can give you a clearer picture of a deal’s potential…

Read MoreCan Internal Rate of Return in Real Estate Predict Success?

If you’re investing in real estate, understanding the internal rate of return (IRR) can help you compare deals and forecast potential profits. IRR is the annualized rate of growth an investment is expected to generate, factoring in both the timing and amount of cash flows throughout the investment period. This makes it an invaluable tool…

Read MoreHow to Evaluate Property Investment Returns Like a Pro

Evaluating property investment returns doesn’t have to be overwhelming, even with today’s complex real estate market. You can measure your investment’s profitability using well-established metrics like ROI, cash flow, and capitalization rate, helping you make smarter, data-driven decisions. With the right approach, you’ll identify not only strong returns but also warning signs that might indicate…

Read MoreBuy vs Rent Analysis: Find the Best Markets to Invest

As a real estate investor, you need more than just local knowledge and gut instinct to pinpoint markets with the highest potential. A buy vs rent analysis gives you direct, data-driven insight into where your capital is likely to perform best. By comparing the financials of renting versus buying in different areas, you can more…

Read MoreAnnual Rate of Return on Rental Property: What Investors Miss

Calculating returns on rental properties involves more than just collecting monthly rent checks. Many investors focus solely on rental income while overlooking crucial factors that impact their true annual returns. The annual rate of return on rental property typically ranges from 6% to 12% when factoring in appreciation, cash flow, and tax benefits. The ROI…

Read MoreRule of 72 for Real Estate: Property Investment Doubling Time

Making smart investment decisions in real estate requires understanding key financial principles that can help predict returns. The Rule of 72 is a powerful mathematical shortcut that helps you estimate how long it will take for your investment to double in value. By dividing 72 by your expected annual return rate, you can quickly calculate…

Read MoreThe Power of Off Plan Real Estate Investing

Off plan real estate investing represents a strategic approach to real estate where you purchase properties during their planning or construction phase. By investing in properties before completion, you can secure units at below-market prices and potentially achieve significant capital gains as the development progresses to completion. When you invest in off-plan properties, you’re essentially…

Read MoreHow to Maximize ROI on Your Mixed Use Property Investment

Investing in mixed-use properties offers a unique opportunity to diversify your real estate portfolio while maximizing potential returns. These versatile properties combine multiple uses – like retail, residential, and office space – all within a single development, creating vibrant spaces that serve various community needs. Your mixed-use property investment can generate multiple income streams, with…

Read More