Investors

Single-Family Home Investment Analysis: Secrets to Success

A successful single-family home investment starts with a solid analysis grounded in the right data and realistic assumptions. Understanding how to properly analyze a potential property gives you a crucial edge, maximizing your ability to find profitable opportunities and avoid costly mistakes. Focusing on straightforward numbers like cash flow, expenses, and local market trends is…

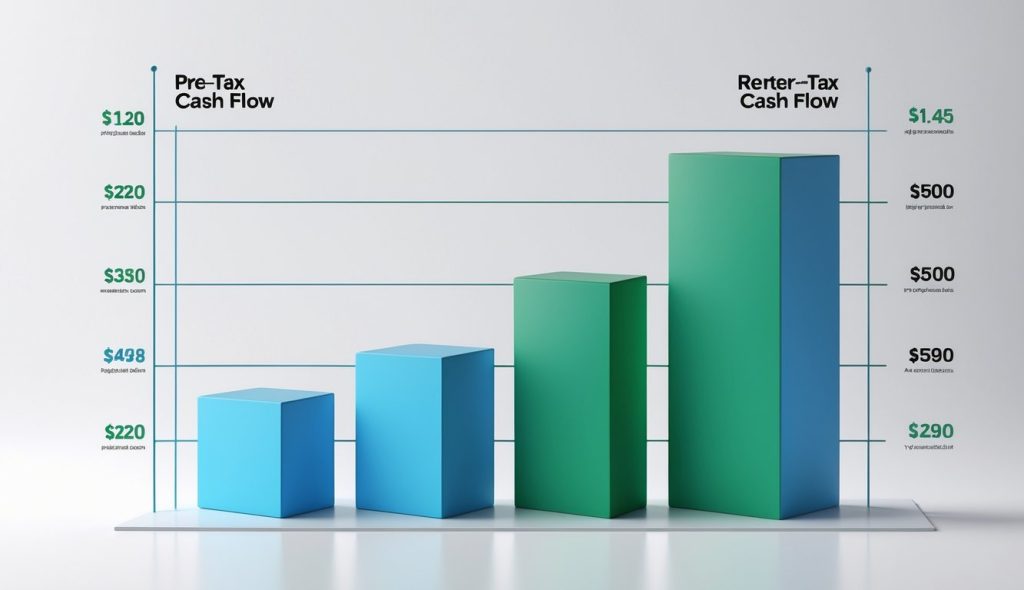

Read MoreHow to Maximize Pre-Tax Cash Flow in Real Estate Investing

Understanding your property’s pre-tax cash flow can make the difference between a profitable investment and a financial pitfall. Pre-tax cash flow is the amount of money your investment generates after accounting for operating expenses and debt service, but before any taxes are paid. Knowing how to calculate and analyze this metric gives you a more…

Read MoreVirtual Property Management Assistant: A Landlord’s Secret Weapon

Managing rental properties involves a constant stream of tasks, from tenant communication to maintenance coordination. The demands on your time can be overwhelming and distract from growing your portfolio or improving profitability. Hiring a virtual property management assistant allows you to delegate routine work to a skilled professional, freeing you to focus on higher-value opportunities.…

Read MoreThe Truth About Cash on Cash Return in Today’s Market

Understanding which numbers really matter is crucial when investing in real estate. Cash on cash return is a simple yet powerful way to measure the actual cash income you earn compared to the cash you invest in a property. Knowing how to use this metric can give you a clearer picture of a deal’s potential…

Read MoreTime the Real Estate Market or Buy and Hold?

Many investors believe that timing the market is the key to maximizing profits, while others argue that a buy-and-hold approach offers better long-term stability. Regardless of your experience level, knowing how to distinguish between these strategies and their potential outcomes can significantly impact your investment performance. While the concept of buying at the bottom and…

Read MoreInvestor’s Guide to Discounted Cash Flow in Real Estate

Unlocking the full potential of your real estate investments starts with understanding how to evaluate future returns. Discounted cash flow (DCF) is a straightforward method that lets you estimate the present value of an income-producing property by calculating the future net cash flows and discounting them to today’s dollars. This approach provides a data-driven way…

Read MoreReal Estate Debt Fund Investing: Risks and Rewards

Looking for a way to get into real estate without the headaches of direct property ownership? Real estate debt fund investing might just fit the bill. A real estate debt fund lets you earn potential returns by lending money to real estate owners and developers. Instead of owning the property, you get income through interest…

Read MoreHow To Use the Elliott Wave Theory in Real Estate Investing

If you’re searching for new ways to analyze real estate markets, you’ve likely come across Elliott Wave Theory. This approach, originally popular in stock market analysis, identifies wave-like price patterns that can indicate future market movements in real estate as well. Applying Elliott Wave Theory gives you another lens to spot cycles and potential opportunities…

Read MoreRaise Capital in Real Estate Without Breaking the Bank

Unlocking new opportunities in property investment doesn’t have to drain your finances. You can raise capital in real estate through a mix of equity partnerships, private capital, bank financing, and crowdfunding—all while protecting your interests and minimizing out-of-pocket costs. Understanding the right funding strategy can be the difference between limited growth and building a dynamic…

Read MoreLOI in Real Estate: What Every Investor Needs to Know

If you’re active in real estate investing, you’ve probably heard the term “LOI” come up in almost every transaction. A Letter of Intent (LOI) in real estate is a short, straightforward document used to outline key terms of a potential purchase or lease before negotiating a final contract. Knowing how and when to use an…

Read MoreKey Facts About a Real Estate Promissory Note

If you invest in real estate, you’ve probably seen the term “promissory note” in contracts or loan paperwork. A real estate promissory note is a legally binding document in which a borrower promises to repay a loan to a lender under specific terms. These notes are a standard part of most property transactions and play…

Read More