What Sets Luxury Fitness Studio Investments Apart?

If you are exploring new opportunities in real estate, luxury fitness studios are standing out as unique investment prospects with specialized appeal. Luxury fitness studios differentiate themselves by offering exclusive amenities, high-end design, and personalized services that attract an affluent clientele willing to pay a premium for a superior experience. This rapidly growing sector combines…

Read MoreHotel Construction Pipeline Trends 2025: Key Markets for Investors

In Q1 2025, the U.S. hotel construction pipeline expanded by 5% in projects and 6% in rooms year-over-year, indicating continued momentum for new developments. Cities across the country are seeing significant activity, opening new possibilities for those keeping a close eye on market shifts. You’ll find that certain metropolitan areas are leading with unprecedented growth,…

Read MoreSingle-Family Home Investment Analysis: Secrets to Success

A successful single-family home investment starts with a solid analysis grounded in the right data and realistic assumptions. Understanding how to properly analyze a potential property gives you a crucial edge, maximizing your ability to find profitable opportunities and avoid costly mistakes. Focusing on straightforward numbers like cash flow, expenses, and local market trends is…

Read MoreCan You Really Benefit From a Lease Assignment?

Commercial leases can be complex, especially if your business needs change before your lease term ends. Whether you’re growing faster than expected, scaling back operations, or simply want to exit a space early, understanding your options is crucial. A lease assignment can allow you to transfer your current lease—and all its obligations—to another tenant, with…

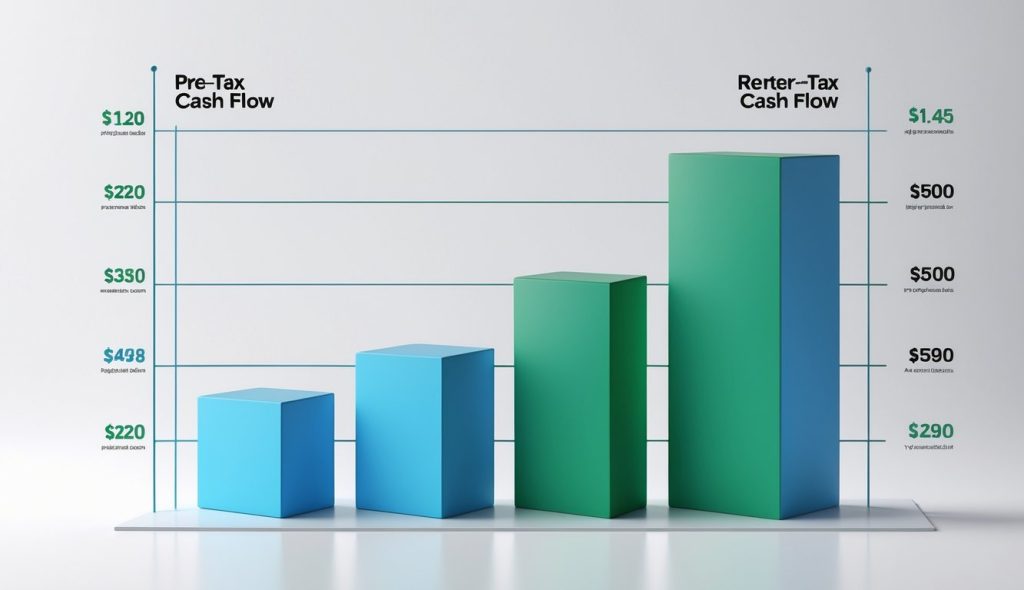

Read MoreHow to Maximize Pre-Tax Cash Flow in Real Estate Investing

Understanding your property’s pre-tax cash flow can make the difference between a profitable investment and a financial pitfall. Pre-tax cash flow is the amount of money your investment generates after accounting for operating expenses and debt service, but before any taxes are paid. Knowing how to calculate and analyze this metric gives you a more…

Read MoreVirtual Property Management Assistant: A Landlord’s Secret Weapon

Managing rental properties involves a constant stream of tasks, from tenant communication to maintenance coordination. The demands on your time can be overwhelming and distract from growing your portfolio or improving profitability. Hiring a virtual property management assistant allows you to delegate routine work to a skilled professional, freeing you to focus on higher-value opportunities.…

Read MoreWill the US always be a renter nation?

Wednesday Wake-Up May 21 2025: Will the US always be a renter nation? One of the ways I relax in the evening after a long day’s work is by watching YouTube videos. But…not the ones with cute pets or music videos. I prefer to focus on continuing education. Which might seem an odd way of…

Read MoreThe Truth About Cash on Cash Return in Today’s Market

Understanding which numbers really matter is crucial when investing in real estate. Cash on cash return is a simple yet powerful way to measure the actual cash income you earn compared to the cash you invest in a property. Knowing how to use this metric can give you a clearer picture of a deal’s potential…

Read MoreTime the Real Estate Market or Buy and Hold?

Many investors believe that timing the market is the key to maximizing profits, while others argue that a buy-and-hold approach offers better long-term stability. Regardless of your experience level, knowing how to distinguish between these strategies and their potential outcomes can significantly impact your investment performance. While the concept of buying at the bottom and…

Read MoreInvestor’s Guide to Discounted Cash Flow in Real Estate

Unlocking the full potential of your real estate investments starts with understanding how to evaluate future returns. Discounted cash flow (DCF) is a straightforward method that lets you estimate the present value of an income-producing property by calculating the future net cash flows and discounting them to today’s dollars. This approach provides a data-driven way…

Read MoreReal Estate Debt Fund Investing: Risks and Rewards

Looking for a way to get into real estate without the headaches of direct property ownership? Real estate debt fund investing might just fit the bill. A real estate debt fund lets you earn potential returns by lending money to real estate owners and developers. Instead of owning the property, you get income through interest…

Read More