Property Analysis

Is Your Real Estate Pro-Forma Accurate Enough?

A real estate pro-forma is one of the most important tools you have for projecting the future performance of your property investments. A pro-forma provides a detailed forecast of your property’s expected income, expenses, and cash flow, helping you evaluate risk and opportunity before you invest. When your decisions depend on accurate data, even small…

Read MoreHow To Master Wholesale Real Estate Management

Managing wholesale real estate is different from traditional property management because you operate as a middle person, focusing on contracts rather than renovations or long-term ownership. When you understand wholesale real estate management, you can streamline deals, minimize risks, and maximize your profit potential in a competitive market. Strong organizational skills, firm negotiation tactics, and…

Read MoreWhat Do Days on Market Really Mean for Investors?

Understanding how long properties linger on the market can help you find the best investment deals and avoid hidden pitfalls. Days on market is the number of days a property is actively listed before it goes under contract or is sold, and it can reveal both market trends and the desirability of a specific property.…

Read MoreAI Data Center Property Investments vs. Traditional Options

If you’re evaluating where to allocate your capital next, the rapid expansion of artificial intelligence means data centers are capturing more investor attention than ever before. AI data center property investments offer compelling growth potential and can serve as a strategic, high-yield alternative to traditional commercial real estate portfolios. With AI fueling unprecedented digital demand,…

Read MoreReal Estate Risk Modeling: Best Practices for Investors

Real estate risk modeling is the discipline of using data-driven tools and techniques to assess, quantify, and manage the uncertainty in property investments. Whether you are working with commercial, residential, or mixed-use properties, understanding potential risks can help you make smarter investment decisions and avoid costly mistakes. By exploring effective strategies for evaluating risk, you…

Read MoreWhat Sets Luxury Fitness Studio Investments Apart?

If you are exploring new opportunities in real estate, luxury fitness studios are standing out as unique investment prospects with specialized appeal. Luxury fitness studios differentiate themselves by offering exclusive amenities, high-end design, and personalized services that attract an affluent clientele willing to pay a premium for a superior experience. This rapidly growing sector combines…

Read MoreHotel Construction Pipeline Trends 2025: Key Markets for Investors

In Q1 2025, the U.S. hotel construction pipeline expanded by 5% in projects and 6% in rooms year-over-year, indicating continued momentum for new developments. Cities across the country are seeing significant activity, opening new possibilities for those keeping a close eye on market shifts. You’ll find that certain metropolitan areas are leading with unprecedented growth,…

Read MoreSingle-Family Home Investment Analysis: Secrets to Success

A successful single-family home investment starts with a solid analysis grounded in the right data and realistic assumptions. Understanding how to properly analyze a potential property gives you a crucial edge, maximizing your ability to find profitable opportunities and avoid costly mistakes. Focusing on straightforward numbers like cash flow, expenses, and local market trends is…

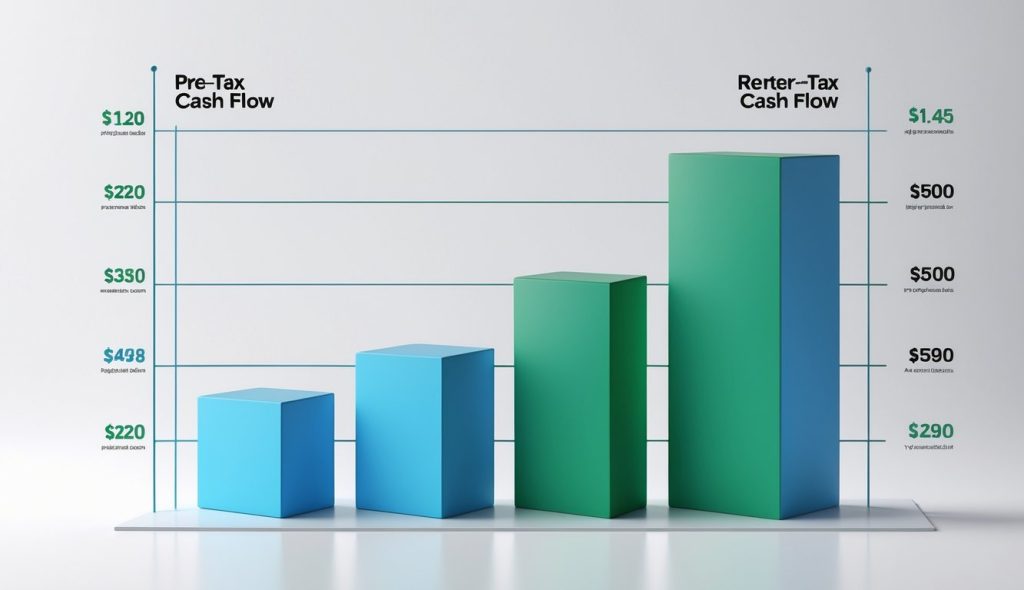

Read MoreHow to Maximize Pre-Tax Cash Flow in Real Estate Investing

Understanding your property’s pre-tax cash flow can make the difference between a profitable investment and a financial pitfall. Pre-tax cash flow is the amount of money your investment generates after accounting for operating expenses and debt service, but before any taxes are paid. Knowing how to calculate and analyze this metric gives you a more…

Read MoreThe Truth About Cash on Cash Return in Today’s Market

Understanding which numbers really matter is crucial when investing in real estate. Cash on cash return is a simple yet powerful way to measure the actual cash income you earn compared to the cash you invest in a property. Knowing how to use this metric can give you a clearer picture of a deal’s potential…

Read MoreInvestor’s Guide to Discounted Cash Flow in Real Estate

Unlocking the full potential of your real estate investments starts with understanding how to evaluate future returns. Discounted cash flow (DCF) is a straightforward method that lets you estimate the present value of an income-producing property by calculating the future net cash flows and discounting them to today’s dollars. This approach provides a data-driven way…

Read More