Financing

How to Build a Scalable Real Estate Investment Business

Building a scalable real estate investment business means designing a company that can grow without losing efficiency or control. You’ll need the right strategies, systems, and team to ensure your business expands smoothly as you acquire more properties and enter new markets. Investors who understand how to scale set themselves up for long-term success and…

Read MoreAI Data Center Property Investments vs. Traditional Options

If you’re evaluating where to allocate your capital next, the rapid expansion of artificial intelligence means data centers are capturing more investor attention than ever before. AI data center property investments offer compelling growth potential and can serve as a strategic, high-yield alternative to traditional commercial real estate portfolios. With AI fueling unprecedented digital demand,…

Read MoreHow Private Wealth Embraces Institutional Tactics in CRE

Private investors are entering a new era in commercial real estate by adopting strategic methods that were once the domain of large institutions. You are now seeing private wealth adopting professional teams, advanced analytics, and data-driven decision-making to compete on the same level as institutional investors. This approach is changing the landscape, allowing private investors…

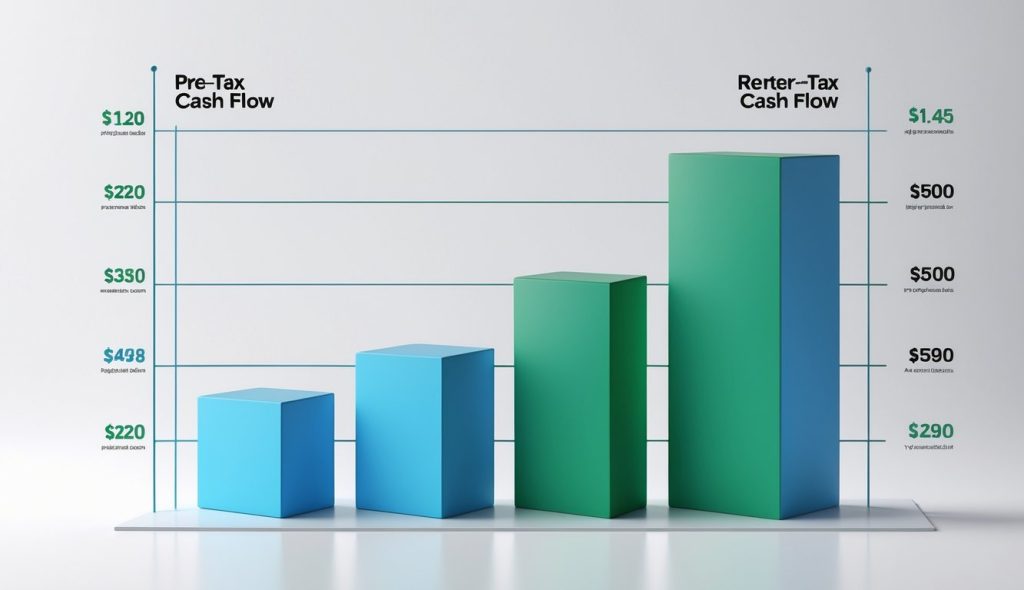

Read MoreHow to Maximize Pre-Tax Cash Flow in Real Estate Investing

Understanding your property’s pre-tax cash flow can make the difference between a profitable investment and a financial pitfall. Pre-tax cash flow is the amount of money your investment generates after accounting for operating expenses and debt service, but before any taxes are paid. Knowing how to calculate and analyze this metric gives you a more…

Read MoreInvestor’s Guide to Discounted Cash Flow in Real Estate

Unlocking the full potential of your real estate investments starts with understanding how to evaluate future returns. Discounted cash flow (DCF) is a straightforward method that lets you estimate the present value of an income-producing property by calculating the future net cash flows and discounting them to today’s dollars. This approach provides a data-driven way…

Read MoreReal Estate Debt Fund Investing: Risks and Rewards

Looking for a way to get into real estate without the headaches of direct property ownership? Real estate debt fund investing might just fit the bill. A real estate debt fund lets you earn potential returns by lending money to real estate owners and developers. Instead of owning the property, you get income through interest…

Read MoreRaise Capital in Real Estate Without Breaking the Bank

Unlocking new opportunities in property investment doesn’t have to drain your finances. You can raise capital in real estate through a mix of equity partnerships, private capital, bank financing, and crowdfunding—all while protecting your interests and minimizing out-of-pocket costs. Understanding the right funding strategy can be the difference between limited growth and building a dynamic…

Read MoreKey Facts About a Real Estate Promissory Note

If you invest in real estate, you’ve probably seen the term “promissory note” in contracts or loan paperwork. A real estate promissory note is a legally binding document in which a borrower promises to repay a loan to a lender under specific terms. These notes are a standard part of most property transactions and play…

Read MoreHow a Tokenized Real Estate Fund Is Changing Property Investment

A tokenized real estate fund lets you invest in real estate using blockchain technology, offering fractional ownership, more liquidity, and smaller minimums than traditional funds. With this model, your investment is represented by digital tokens, each tied to a portion of the underlying property or cash flow. This makes getting exposure to high-quality, institutionally backed…

Read MoreEquity Multiple in Real Estate Explained Simply

When evaluating real estate investments, you need clear metrics to measure performance and guide your decisions. Equity multiple is a straightforward ratio that shows you how much your original investment has grown over time. Understanding this metric helps you compare opportunities and set realistic expectations for your returns. Equity multiple tells you how much total…

Read MoreBusiness Plan Development for Real Estate Portfolio: How-to Guide

Building a profitable real estate portfolio requires more than just acquiring properties—it starts with a clear and actionable business plan. A well-crafted business plan for your real estate portfolio helps you define your investment goals, identify growth opportunities, and manage risks with greater confidence and efficiency. By developing a structured roadmap, you make smarter decisions…

Read More