Financing

Digital Real Estate: The New Frontier for Bitcoin Investors

Digital real estate is transforming the way we think about property ownership and investment. This emerging concept encompasses virtual land, websites, domain names, and tokenized real-world assets. Digital real estate offers new opportunities for investors to diversify their portfolios and participate in the rapidly evolving digital economy. As blockchain technology advances, the lines between physical…

Read MoreBitcoin Real Estate Synergy: Unlocking New Investment Frontiers

Bitcoin and real estate, two seemingly disparate investment realms, have found an unexpected synergy in recent years. As cryptocurrency gains mainstream acceptance, savvy investors are exploring innovative ways to leverage digital assets in the property market. You can now buy real estate with Bitcoin, opening up new possibilities for diversifying your investment portfolio and potentially…

Read MoreTactical Bitcoin Investment Plan for Real Estate: A Beginner’s Guide

Investing in real estate has long been a popular strategy for building wealth. In recent years, Bitcoin has emerged as a new asset class that’s capturing the attention of investors worldwide. Combining these two investment approaches can create unique opportunities for savvy investors. A tactical Bitcoin investment plan for real estate involves strategically acquiring and…

Read MoreWhat Are Special Servicing Loans?

Special servicing loans play a crucial role when real estate investments encounter financial troubles. Imagine you’ve invested in a promising property, only to face unexpected market shifts that put the loan at risk of default. When a borrower can’t meet their loan terms, special servicers dive in to find solutions, whether it’s through loan restructuring…

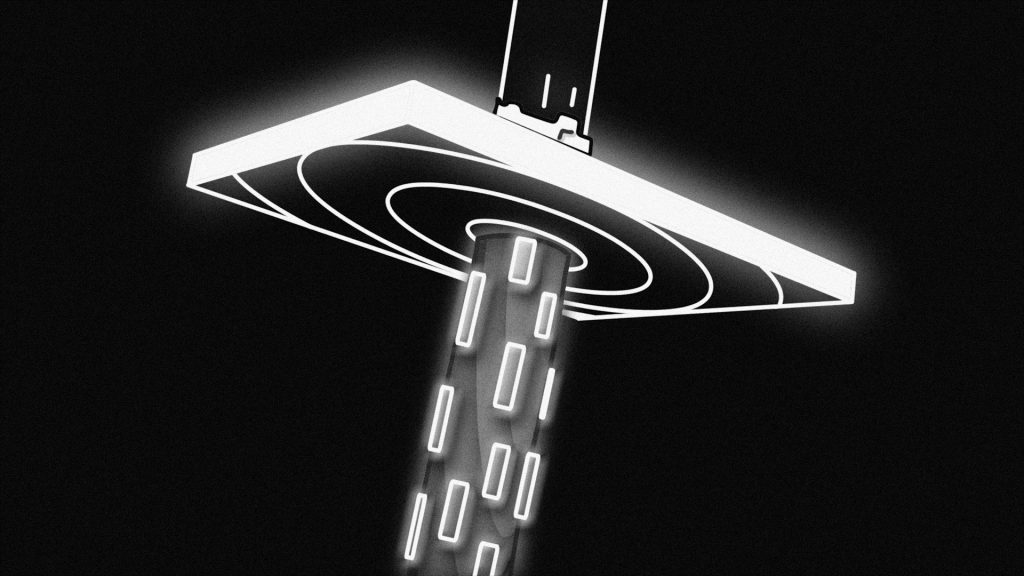

Read MoreWhat Is Real Estate Tokenization?

Real estate investment has traditionally required substantial capital and involved complex, time-consuming transactions. These barriers have kept many investors from accessing more profitable property markets, especially high-value commercial or luxury assets. Tokenization changes this by breaking ownership into digital shares, allowing investors to buy and sell fractions of properties with ease. This shift leverages blockchain…

Read MoreWhat Are Real Estate Syndication Deals?

Accessing high-value real estate investments often requires more capital and expertise than individual investors can provide on their own. Real estate syndication offers a solution by pooling resources from multiple investors to acquire larger, and potentially more lucrative properties. This approach opens doors to opportunities that would otherwise be out of reach. In a syndication…

Read MoreHow To Monetize Commercial Real Estate Assets

Owning commercial real estate often means tying up significant capital that could otherwise be used to grow your core business. For many owner-occupants, the financial strain from maintenance costs, taxes, and market fluctuations creates cash flow challenges that limit business agility and expansion opportunities. These pressures can distract from essential operations and stunt growth. Monetizing…

Read MoreHow Does a Real Estate Flip Work?

A real estate flip is a strategic investment where an undervalued or outdated property is purchased, renovated, and then sold for a profit within a short timeframe. This approach focuses on increasing the property’s market value through targeted improvements, allowing investors to capitalize on the difference between the purchase price and the resale price. Unlike…

Read MoreWhat Is Real Estate Shadow Lending?

Real estate shadow lending has become a critical yet often misunderstood component of property financing. Unlike traditional bank loans, shadow lending operates through private lenders and non-bank entities, offering faster access to capital but with unique risks and regulations. Understanding how shadow lending works is essential for investors and property managers who want to leverage…

Read MoreWhat Is Real Estate Syndication?

Real estate syndication has opened up new opportunities for investors who want to grow their portfolios beyond traditional options. By joining forces with other investors, you can take part in large commercial property deals, sharing both the investment and the potential returns. This approach gives you a way to invest in real estate without taking…

Read MoreThings To Know About A Real Estate Syndication

Real estate syndication offers individual investors the opportunity to pool their resources and invest in high-value properties that would otherwise be out of reach. This collaborative approach allows participants to share both the risks and rewards of property ownership, while benefiting from professional management and expertise. Understanding how syndications work is essential for anyone looking…

Read More